is the irs collecting back taxes

After that the debt is wiped clean from its books and the IRS writes it off. Generally speaking when it comes to a tax audit the IRS is only able to go back three years.

Back Taxes And Tax Debt Tax Tips And Resources Jackson Hewitt

For a lot of people that statement right there will help them breathe a sigh of relief.

. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. The statute of limitations for back taxes is 10 years. Essentially the IRS is mandated to collect your unpaid taxes within.

Lets start with the good news. The IRS has a limited amount of time to collect back taxes. Most taxpayers can rest assured that after 3 years it is highly unlikely.

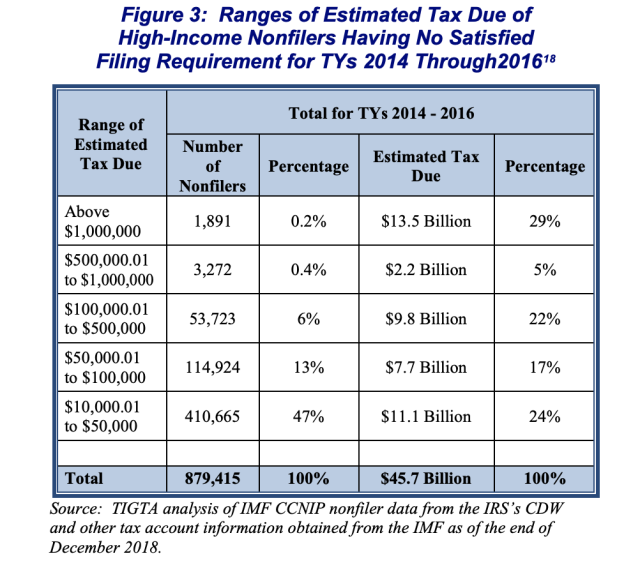

If your obligation isnt paid by the end of this period which is the CSED the IRS will have almost no options for collecting. After that the debts are erased from their books and the IRS cancels them. The Internal Revenue Service IRS didnt investigate 42 of those cases representing 208 billion in lost tax revenue because of lack of oversight and dwindling.

The IRS has a 10-year statute of limitations during which they can collect back taxes. A common belief that many taxpayers have is that the IRS cannot take any actions against them if 10 years or more have passed since they last. 1 hour agoThe IRS has sent 9 million letters to those who may still be due stimulus funds.

153 Likes 6 Comments. Form 433-B Collection Information Statement for Businesses PDF. This number reveals how many Americans do not regularly file a tax return.

If there are substantial errors they may go back further but typically no more than. After the IRS determines that additional taxes are due the IRS has 10 years to collect unpaid taxes. TikTok video from Mr Tax Problem Solver sempertaxrelief.

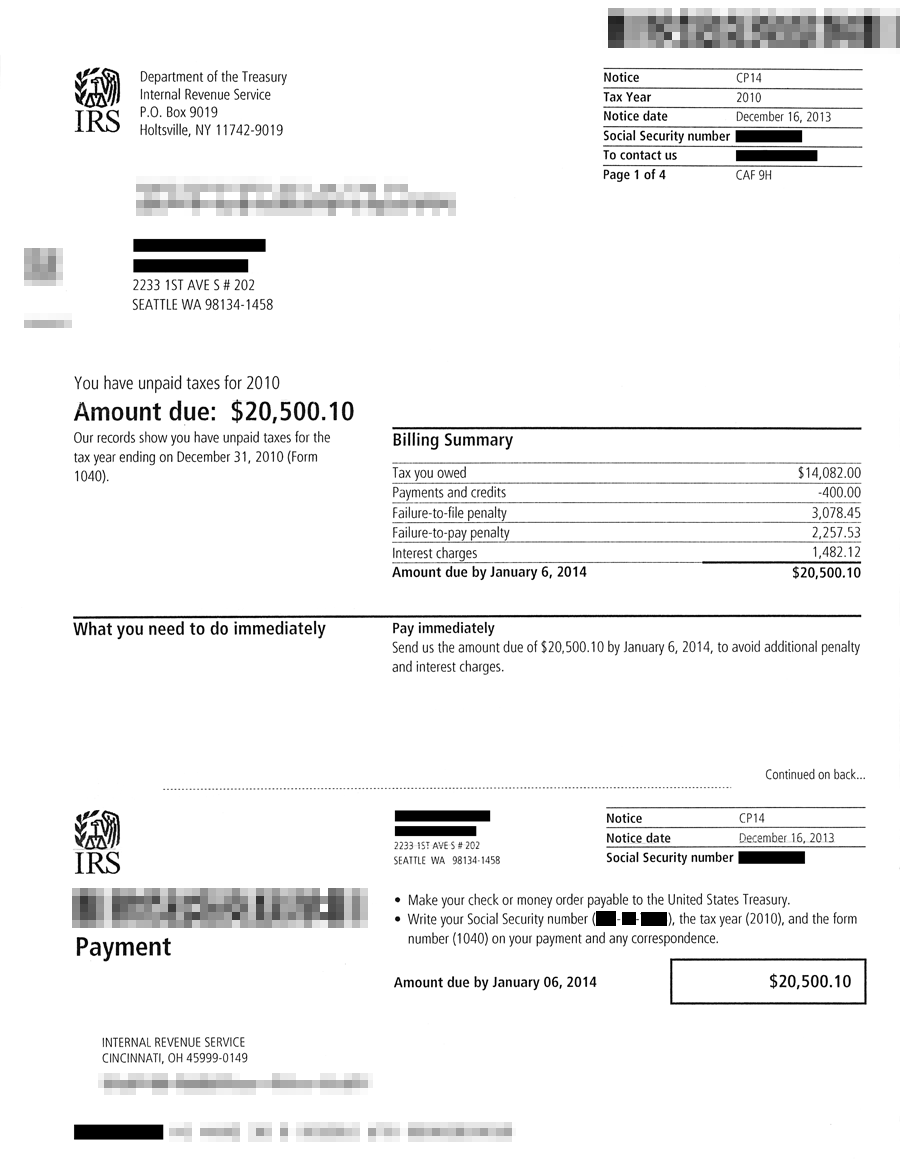

The start of the limitation period begins on the date of the tax assessment by an IRS official. If the IRS has placed a tax lien on your property then that lien will. This generally begins with notices of deficiency followed by a notice of intent to levy.

During the 10-year period the IRS has many tools to collect back taxes. Registering to collect tax in British Columbia When to register. The IRS will attempt to collect the back taxes owed with involuntary collections such as tax liens wage.

Is the Irs Collecting Back Taxes. BC requires businesses making taxable sales of goods or services in the province including software and telecommunication. If you owe the IRS back taxes you may be wondering if the IRS forgives tax debt.

As a general rule there is an established ten-year statute of limitations for the IRS to collect unpaid tax debts. Typically the Internal Revenue Service IRS has 10 years to collect outstanding tax debts. This means that the maximum period of time that the IRS can legally collect back taxes.

The federal tax lien statute of limitations is the exact same limitation as the one for back tax collection. There are several options here so we will be looking at the best path forward for you. Form 433-A Collection Information Statement for Wage Earners and Self-Employed Individuals PDF.

Typically if you file your tax return and dont pay. For many people with back taxes due an important consideration is the time limit. With a simple online search people can discover that generally the IRS has 10 years to collect.

Although the internal revenue service can only collect back taxes for a period of ten years starting from the day your tax was assessed but there are some factors that can extend. This is called the 10-year. The risk of tax fraud is.

The Statute of Limitations for Unfiled Taxes.

Does The Irs Forgive Tax Debt After 10 Years Heartland Tax Solutions

Back Taxes Archives New Jersey Tax Attorney Top Irs Tax Lawyer In Nj Pa

Soi Tax Stats Irs Data Book Internal Revenue Service

Returns Filed Taxes Collected And Refunds Issued Internal Revenue Service

Tax Letters Washington Tax Services

Collections Activities Penalties And Appeals Internal Revenue Service

Don T Lose Your Passport Over Unpaid Back Taxes

Compliance Presence Internal Revenue Service

How Irs Collection Is Helping Taxpayers During The Pandemic Internal Revenue Service

How Long Does The Irs Have To Collect Back Taxes Understanding C S E D Dates Do You Owe Back Taxes To The Irs Or State You Know You Owe Back Taxes To The

What Can You Expect In The Irs Collection Process Supermoney

Why You Should Never Ignore An Irs Tax Bill Jackson Hewitt

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

The Irs Is Failing To Collect Billions In Back Taxes Owed By Super Rich Americans

How The Irs Collects Unpaid Taxes Owed To Them Youtube

How Does The Irs Collect Unpaid Taxes Wiztax

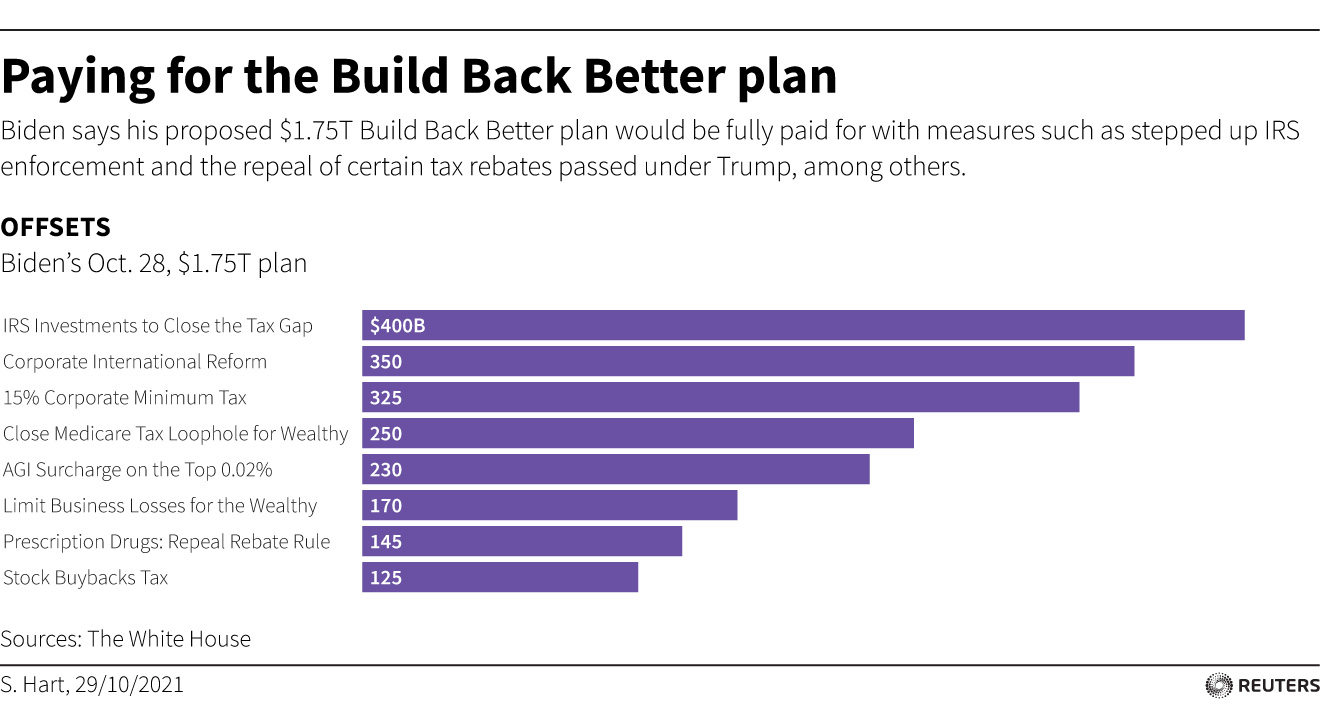

Irs Plan To Collect 400 Bln In Unpaid Taxes Relies On Deterrence Treasury S Adeyemo Reuters